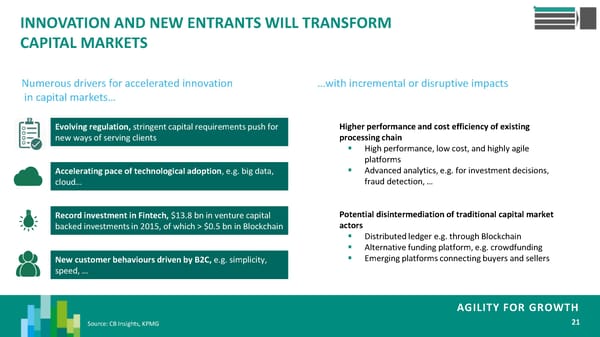

INNOVATION AND NEW ENTRANTS WILL TRANSFORM CAPITAL MARKETS Numerous drivers for accelerated innovation …with incremental or disruptive impacts in capital markets… Evolving regulation, stringent capital requirements push for Higher performance and cost efficiency of existing new ways of serving clients processing chain High performance, low cost, and highly agile platforms Accelerating pace of technological adoption, e.g. big data, Advanced analytics, e.g. for investment decisions, cloud… fraud detection, … Record investment in Fintech, $13.8 bn in venture capital Potential disintermediation of traditional capital market backed investments in 2015, of which > $0.5 bn in Blockchain actors Distributed ledger e.g. through Blockchain Alternative funding platform, e.g. crowdfunding New customer behaviours driven by B2C, e.g. simplicity, Emerging platforms connecting buyers and sellers speed, … AGILITY FOR GROWTH Source: CB Insights, KPMG 21

Agility For Growth Page 23 Page 25

Agility For Growth Page 23 Page 25