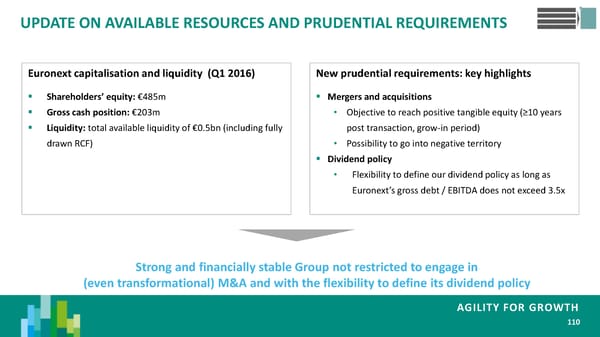

UPDATE ON AVAILABLE RESOURCES AND PRUDENTIAL REQUIREMENTS Euronext capitalisation and liquidity (Q1 2016) New prudential requirements: key highlights Shareholders’ equity: €485m Mergers and acquisitions Gross cash position: €203m • Objective to reach positive tangible equity (≥10 years Liquidity: total available liquidity of €0.5bn (including fully post transaction, grow-in period) drawn RCF) • Possibility to go into negative territory Dividend policy • Flexibility to define our dividend policy as long as Euronext’s gross debt / EBITDA does not exceed 3.5x Strong and financially stable Group not restricted to engage in (even transformational) M&A and with the flexibility to define its dividend policy AGILITY FOR GROWTH 110

Agility For Growth Page 107 Page 109

Agility For Growth Page 107 Page 109