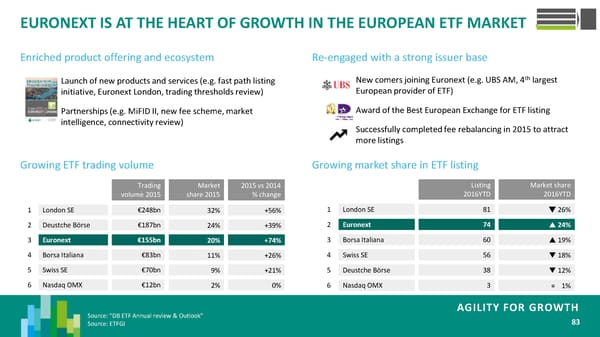

EURONEXT IS AT THE HEART OF GROWTH IN THE EUROPEAN ETF MARKET Enriched product offering and ecosystem Re-engaged with a strong issuer base Launch of new products and services (e.g. fast path listing New comers joining Euronext (e.g. UBS AM, 4th largest initiative, Euronext London, trading thresholds review) European provider of ETF) Partnerships (e.g. MiFID II, new fee scheme, market Award of the Best European Exchange for ETF listing intelligence, connectivity review) Successfully completed fee rebalancing in 2015 to attract more listings Growing ETF trading volume Growing market share in ETF listing Trading Market 2015 vs 2014 Listing Market share volume 2015 share 2015 % change 2016YTD 2016YTD 1 London SE €248bn 32% +56% 1 London SE 81 26% 2 Euronext 74 24% 2 Deustche Börse €187bn 24% +39% 3 Euronext €155bn 3 Borsa Italiana 60 19% 20% +74% 4 Borsa Italiana €83bn 11% +26% 4 Swiss SE 56 18% 5 Swiss SE €70bn 9% +21% 5 Deustche Börse 38 12% 6 Nasdaq OMX €12bn 2% 0% 6 Nasdaq OMX 3 = 1% AGILITY FOR GROWTH Source: “DB ETF Annual review & Outlook” 83 Source: ETFGI

Agility For Growth Page 83 Page 85

Agility For Growth Page 83 Page 85