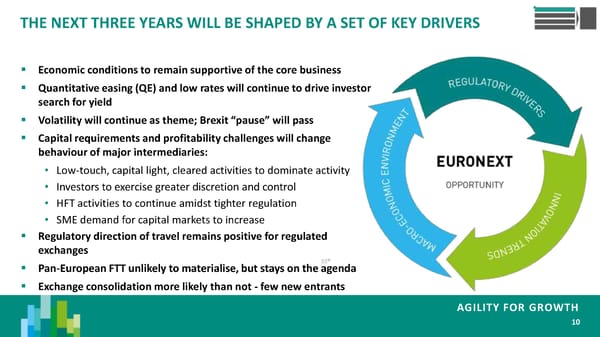

THE NEXT THREE YEARS WILL BE SHAPED BY A SET OF KEY DRIVERS Economic conditions to remain supportive of the core business Quantitative easing (QE) and low rates will continue to drive investor search for yield Volatility will continue as theme; Brexit “pause” will pass Capital requirements and profitability challenges will change behaviour of major intermediaries: • Low-touch, capital light, cleared activities to dominate activity • Investors to exercise greater discretion and control • HFT activities to continue amidst tighter regulation • SME demand for capital markets to increase Regulatory direction of travel remains positive for regulated exchanges Pan-European FTT unlikely to materialise, but stays on the agenda Exchange consolidation more likely than not - few new entrants AGILITY FOR GROWTH 10

Agility For Growth Page 10 Page 12

Agility For Growth Page 10 Page 12