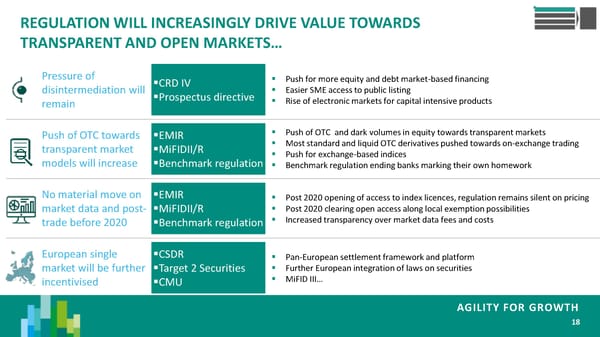

REGULATION WILL INCREASINGLY DRIVE VALUE TOWARDS TRANSPARENT AND OPEN MARKETS… Pressure of CRD IV Push for more equity and debt market-based financing disintermediation will Prospectus directive Easier SME access to public listing remain Rise of electronic markets for capital intensive products Push of OTC towards EMIR Push of OTC and dark volumes in equity towards transparent markets transparent market MiFIDII/R Most standard and liquid OTC derivatives pushed towards on-exchange trading models will increase Benchmark regulation Push for exchange-based indices Benchmark regulation ending banks marking their own homework No material move on EMIR Post 2020 opening of access to index licences, regulation remains silent on pricing market data and post- MiFIDII/R Post 2020 clearing open access along local exemption possibilities trade before 2020 Benchmark regulation Increased transparency over market data fees and costs European single CSDR Pan-European settlement framework and platform market will be further Target 2 Securities Further European integration of laws on securities incentivised CMU MiFID III… AGILITY FOR GROWTH 18

Agility For Growth Page 20 Page 22

Agility For Growth Page 20 Page 22