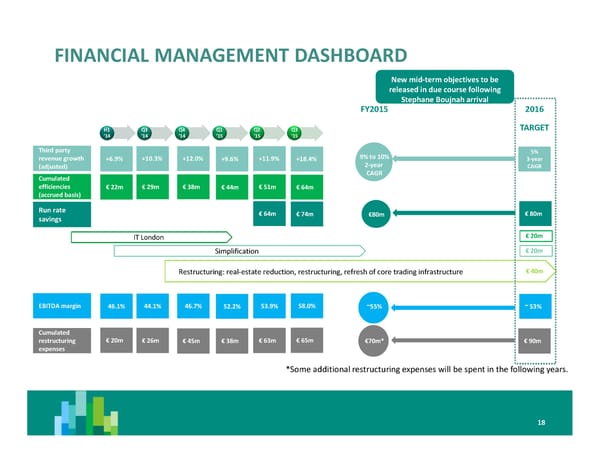

FINANCIAL MANAGEMENT DASHBOARD New mid-termobjectives to be releasedin due course following Stephane Boujnaharrival FY2015 2016 H1 Q3 Q4 Q1 Q2 Q3 TARGET ‘14 ‘14 ‘14 ‘15 ‘15 ‘15 Third party 5% revenue growth +6.9% +10.3% +12.0% +9.6% +11.9% +18.4% 9% to 10% 3-year (adjusted) 2-year CAGR Cumulated CAGR efficiencies €22m €29m €38m €44m €51m €64m (accrued basis) Run rate €64m €74m €80m €80m savings IT London €20m Simplification €20m Restructuring: real-estate reduction, restructuring, refresh of core trading infrastructure €40m EBITDA margin 46.1% 44.1% 46.7% 52.2% 53.9% 58.0% ~55% ~ 53% Cumulated restructuring €20m €26m €45m €38m €63m €65m €70m* €90m expenses *Some additional restructuring expenses will be spent in the following years. 18 | 18

Q3’2015 Results Page 18 Page 20

Q3’2015 Results Page 18 Page 20