Agility For Growth

Investor Day 2016

EURONEXT AGILITY FOR GROWTH 13 MAY 2016 AGILITY FOR GROWTH

DISCLAIMER This presentation is for information purposes only and is not a recommendation to engage in investment activities. The information and materials contained in this presentation are provided ‘as is’ and Euronext does not warrant as to the accuracy, adequacy or completeness of the information and materials and expressly disclaims liability for any errors or omissions. This presentation contains materials (including videos) produced by third parties and this content has been created solely by such third parties with no creative input from Euronext. It is not intended to be, and shall not constitute in any way a binding or legal agreement, or impose any legal obligation on Euronext. All proprietary rights and interest in or connected with this publication shall vest in Euronext. No part of it may be redistributed or reproduced without the prior written permission of Euronext. This presentation may include forward-looking statements, which are based on Euronext’s current expectations and projections about future events. By their nature, forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of Euronext. Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements. Accordingly, no undue reliance should be placed on any forward-looking statements. Forward-looking statements speak only as at the date at which they are made. Euronext expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this presentation to reflect any change in its expectations or any change in events, conditions or circumstances on which such statements are based unless required to do so by applicable law. Financial objectives are internal objectives of the Company to measure its operational performance and should not be read as indicating that the Company is targeting such metrics for any particular fiscal year. The Company’s ability to achieve these financial objectives is inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control, and upon assumptions with respect to future business decisions that are subject to change. As a result, the Company’s actual results may vary from these financial objectives, and those variations may be material. Efficiencies are net, before tax and on a run-rate basis, ie taking into account the full-year impact of any measure to be undertaken before the end of the period mentioned. The expected operating efficiencies and cost savings were prepared on the basis of a number of assumptions, projections and estimates, many of which depend on factors that are beyond the Company’s control. These assumptions, projections and estimates are inherently subject to significant uncertainties and actual results may differ, perhaps materially, from those projected. The Company cannot provide any assurance that these assumptions are correct and that these projections and estimates will reflect the Company's actual results of operations Euronext refers to Euronext N.V. and its affiliates. Information regarding trademarks and intellectual property rights of Euronext is located at https://www.euronext.com/terms-use. © 2016, Euronext N.V. - All rights reserved. AGILITY FOR GROWTH 2

OUR TRACK RECORD: EURONEXT HAS OUTPERFORMED SINCE IPO, REACHING TARGETS A YEAR IN ADVANCE Total shareholder return of 141% since IPO Initial and 80% in 2015 2016 targets €519m 1 Third party revenues €471m (€m) 1 €433m €500m Cost efficiencies (€m) -€83m3 -€60m4 EBITDA margin 29%1,2 42%1 55% 45% 2013 2014 2015 1.Revenues and operating expenses adjusted for the impact of clearing contract AGILITY FOR GROWTH 2.Operating expenses 2013 inflated with expenses related to third-party revenues 3.Run-rate efficiencies as of 31st December 2015 3 4.On a run-rate basis

OUR FUNDAMENTAL ASSETS TO DRIVE FUTURE GROWTH 1 Euronext is a fully independent European player focused on its core European markets 2 Euronext offers a wide range of products, services and platforms with a strong international presence 3 Euronext offers liquidity and transparency to all market participants through its regulated exchanges 4 Euronext’s model is resilient and delivers consistent growth and profitability above that of its comparable peers 5 Euronext is ‘united in diversity’; its open federal model is best suited to contribute to the construction of a true pan-European market OUR MISSION IS TO POWER PAN-EUROPEAN CAPITAL MARKETS TO FINANCE THE REAL ECONOMY AGILITY FOR GROWTH 4

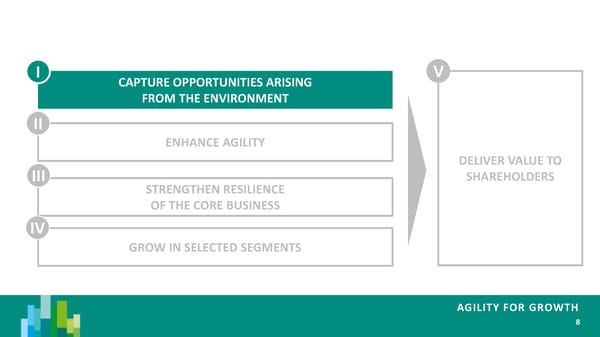

OUR STRATEGIC AMBITIONS UNTIL 2019: AGILITY FOR GROWTH I CAPTURE OPPORTUNITIES ARISING V FROM THE ENVIRONMENT II ENHANCE AGILITY DELIVER VALUE TO III SHAREHOLDERS STRENGTHEN RESILIENCE OF THE CORE BUSINESS IV GROW IN SELECTED SEGMENTS AGILITY FOR GROWTH 5

AGENDA FOR THE DAY – MORNING SESSION Ambitions: Agility for Growth 11:00 Stéphane Boujnah, CEO Euronext I Capture opportunities arising from the environment 11:10 Lee Hodgkinson, Head of Markets and Global Sales 1. Market trends and economic outlook as an opportunity Lee Hodgkinson, Head of Markets and Global Sales 2. Regulation as a driver of our growth Catherine Langlais, General Counsel 3. Innovation as a transforming force of our business Nicolas Rivard, Chief Innovation Officer II Enhance agility 11:40 Stéphane Boujnah, CEO Euronext 1. Cost management discipline Stéphanie Bia, Head of IR and Business Performance 2. Upgraded IT & infrastructure platforms Jos Dijsselhof, COO 3. M&A discipline Stéphane Boujnah, CEO Euronext III Strengthen the resilience of the core business 12:15 Lee Hodgkinson, Head of Markets and Global Sales 1. Listing Anthony Attia, CEO Euronext Paris and Global Head of Listing 2. Cash & derivatives trading Danielle Mensah, Head of Cash Markets Adam Rose, Head of Financial Derivatives 3. Market data and indices Maurice van Tilburg, CEO Euronext Amsterdam A buffet lunch will be served between 13:15 and 13:45 AGILITY FOR GROWTH 6

AGENDA FOR THE DAY – AFTERNOON SESSION IV Grow in selected segments 13:45 Stéphane Boujnah, CEO Euronext 1. Adding value to issuers 1.1 The exchange for European Tech SMEs Eric Forest, CEO EnterNext 1.2 Data & analytics: The modular corporate services provider Lee Hodgkinson, Head of Markets and Global Sales 2. Adding value to investors 2.1 ETFs: One-stop-shop pan-European ETF platform Benjamin Fussien, Head of ETFs 2.2 Indices: Euronext branded European family of indices Adam Rose, Head of Financial Derivatives 2.3 Commodities: Specialist content on agricultural commodities Olivier Raevel, Head of Commodities 2.4 Post trade solutions Andrew Simpson, Head of Post Trade Break 15:15 V Deliver value to shareholders 15:30 Giorgio Modica, CFO Q&A session 15:50 All AGILITY FOR GROWTH 7

I CAPTURE OPPORTUNITIES ARISING V FROM THE ENVIRONMENT II ENHANCE AGILITY DELIVER VALUE TO III SHAREHOLDERS STRENGTHEN RESILIENCE OF THE CORE BUSINESS IV GROW IN SELECTED SEGMENTS AGILITY FOR GROWTH 8

CAPTURE OPPORTUNITIES ARISING FROM THE ENVIRONMENT Market trends and economic outlook as an opportunity Lee Hodgkinson, Head of Markets and Global Sales AGILITY FOR GROWTH

THE NEXT THREE YEARS WILL BE SHAPED BY A SET OF KEY DRIVERS Economic conditions to remain supportive of the core business Quantitative easing (QE) and low rates will continue to drive investor search for yield Volatility will continue as theme; Brexit “pause” will pass Capital requirements and profitability challenges will change behaviour of major intermediaries: • Low-touch, capital light, cleared activities to dominate activity • Investors to exercise greater discretion and control • HFT activities to continue amidst tighter regulation • SME demand for capital markets to increase Regulatory direction of travel remains positive for regulated exchanges Pan-European FTT unlikely to materialise, but stays on the agenda Exchange consolidation more likely than not - few new entrants AGILITY FOR GROWTH 10

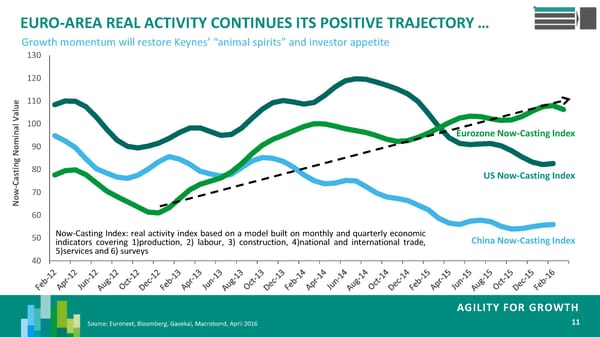

EURO-AREA REAL ACTIVITY CONTINUES ITS POSITIVE TRAJECTORY … Growth momentum will restore Keynes’ “animal spirits” and investor appetite 130 120 lue110 al V an100 mi Eurozone Now-Casting Index o N 90 gn tias80 US Now-Casting Index Cw- 70 oN 60 50 Now-Casting Index: real activity index based on a model built on monthly and quarterly economic China Now-Casting Index indicators covering 1)production, 2) labour, 3) construction, 4)national and international trade, 5)services and 6) surveys 40 AGILITY FOR GROWTH Source: Euronext, Bloomberg, Gavekal, Macrobond, April 2016 11

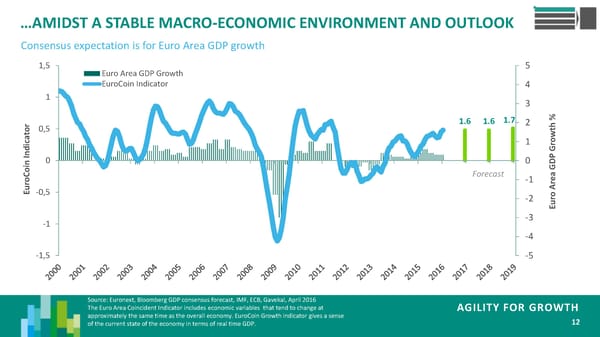

…AMIDST A STABLE MACRO-ECONOMIC ENVIRONMENT AND OUTLOOK Consensus expectation is for Euro Area GDP growth 1,5 Euro Area GDP Growth 5 EuroCoin Indicator 4 1 3 1.7 % rto0,5 1.6 1.6 2 th aic 1 row d In G noi 0 0 GDP Cro Forecast -1 ea Eu-0,5 roAr -2 Eu -1 -3 -4 -1,5 -5 Source: Euronext, Bloomberg GDP consensus forecast, IMF, ECB, Gavekal, April 2016 The Euro Area Coincident Indicator includes economic variables that tend to change at AGILITY FOR GROWTH approximately the same time as the overall economy. EuroCoin Growth indicator gives a sense 12 of the current state of the economy in terms of real time GDP.

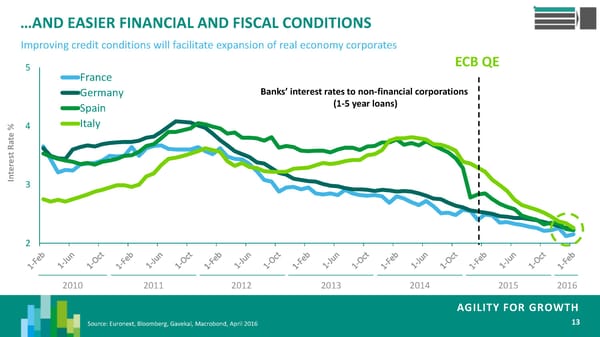

…AND EASIER FINANCIAL AND FISCAL CONDITIONS Improving credit conditions will facilitate expansion of real economy corporates 5 ECB QE France Germany Banks’ interest rates to non-financial corporations Spain (1-5 year loans) %4 Italy teRa rest te nI 3 2 2010 2011 2012 2013 2014 2015 2016 AGILITY FOR GROWTH Source: Euronext, Bloomberg, Gavekal, Macrobond, April 2016 13

MATERIAL QE COMBINED WITH VOLATILITY WILL SUPPORT VOLUME Heightened but not extreme “Goldilocks” volatility is healthy for Euronext’s franchise 10 000 Euronext ADV (€m) Stoxx 50 Volatility Volatility Threshold 60 9 000 ECB QE 8 000 Announcement 50 7 000 lu e m 40 Va 6 000 l €xt na en 5 000 30 omi our 4 000 N En 3 000 20 tility oV 2 000 Sustained periods of ola AD volatility under QE tend to 10 V 1 000 impact volumes positively - e rr y y e r r e r r e r r y e r r ril0 aryuaryarchrilayn Julygustbererbebeuarararchrilayn Julygustbererbebeuaryaryarchrilayn Julygustbererbebeuaryaryarchrilayn Julygustbererbebeuararyarchrilayn JulygustbererbebeuaryaryarchAp rub M Ap M Ju Autemctobvemmnbru M Ap M Ju Autemctobvemmbru M Ap M Ju Autemctobvemmbru M Ap M Ju Autemctobvemmnbru M Ap M Ju AutemctobvemmbruM Jan Fe p O No Dece Ja Fe p O No Dece Jan Fe p O No Dece Jan Fe p O No Dece Ja Fe p O No Dece Jan Fe Se Se Se Se Se 2011 2012 2013 2014 2015 2016 AGILITY FOR GROWTH Source: Euronext, Bloomberg, May 2016 14

EXPERIENCE OF US PEERS SHOWS LITTLE TO FEAR FROM END OF QE At the end of QE, similarly to the US, no negative impact is expected 6 000 000 BATS Global Markets - US Nasdaq - US NYSE 5 000 000 Taper announcement m Fed’s QE taper did not affect ADV on US $ 4 000 000 exchanges negatively USV 3 000 000 AD 2 000 000 1 000 000 - h y ly er er h y ly er er h y ly er er h y ly er er h aryu arc Ma Ju b uaryarc Ma Ju b uary arc Ma Ju b uary arc Ma Ju b uaryarc Jan M ptemovembJan M ptem ovembJan M ptemovembJan M ptem ovembJan M Se N Se N Se N Se N 2012 2013 2014 2015 2016 AGILITY FOR GROWTH Source: Euronext, World Federation of Exchanges, April 2016 15

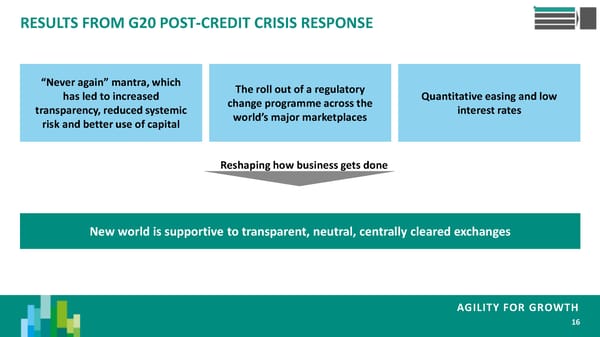

RESULTS FROM G20 POST-CREDIT CRISIS RESPONSE “Never again” mantra, which The roll out of a regulatory has led to increased change programme across the Quantitative easing and low transparency, reduced systemic world’s major marketplaces interest rates risk and better use of capital Reshaping how business gets done New world is supportive to transparent, neutral, centrally cleared exchanges AGILITY FOR GROWTH 16

CAPTURE OPPORTUNITIES ARISING FROM THE ENVIRONMENT Regulation as a driver of our growth Catherine Langlais, General Counsel AGILITY FOR GROWTH

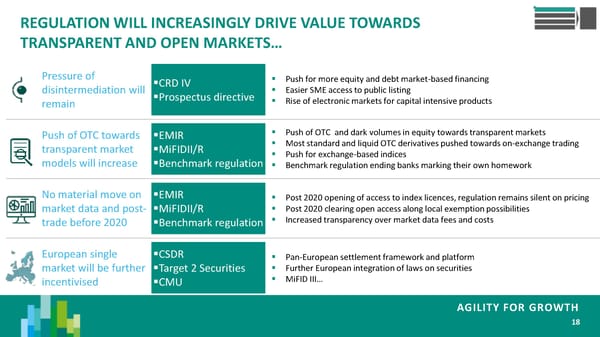

REGULATION WILL INCREASINGLY DRIVE VALUE TOWARDS TRANSPARENT AND OPEN MARKETS… Pressure of CRD IV Push for more equity and debt market-based financing disintermediation will Prospectus directive Easier SME access to public listing remain Rise of electronic markets for capital intensive products Push of OTC towards EMIR Push of OTC and dark volumes in equity towards transparent markets transparent market MiFIDII/R Most standard and liquid OTC derivatives pushed towards on-exchange trading models will increase Benchmark regulation Push for exchange-based indices Benchmark regulation ending banks marking their own homework No material move on EMIR Post 2020 opening of access to index licences, regulation remains silent on pricing market data and post- MiFIDII/R Post 2020 clearing open access along local exemption possibilities trade before 2020 Benchmark regulation Increased transparency over market data fees and costs European single CSDR Pan-European settlement framework and platform market will be further Target 2 Securities Further European integration of laws on securities incentivised CMU MiFID III… AGILITY FOR GROWTH 18

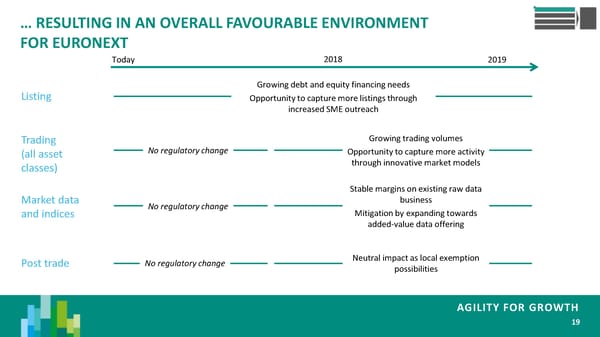

… RESULTING IN AN OVERALL FAVOURABLE ENVIRONMENT FOR EURONEXT Today 2018 2019 Growing debt and equity financing needs Listing Opportunity to capture more listings through increased SME outreach Trading Growing trading volumes (all asset No regulatory change Opportunity to capture more activity classes) through innovative market models Stable margins on existing raw data Market data No regulatory change business and indices Mitigation by expanding towards added-value data offering Post trade No regulatory change Neutral impact as local exemption possibilities AGILITY FOR GROWTH 19

CAPTURE OPPORTUNITIES ARISING FROM THE ENVIRONMENT Innovation as a transforming force of our business Nicolas Rivard, Chief Innovation Officer AGILITY FOR GROWTH

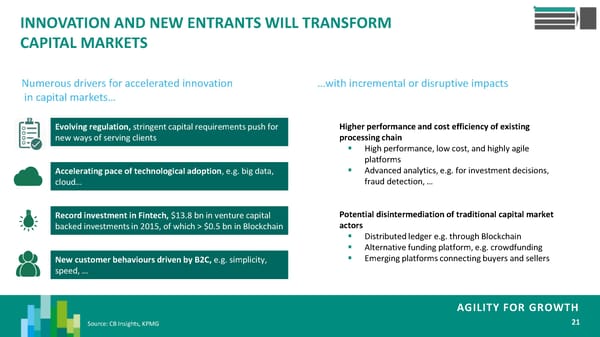

INNOVATION AND NEW ENTRANTS WILL TRANSFORM CAPITAL MARKETS Numerous drivers for accelerated innovation …with incremental or disruptive impacts in capital markets… Evolving regulation, stringent capital requirements push for Higher performance and cost efficiency of existing new ways of serving clients processing chain High performance, low cost, and highly agile platforms Accelerating pace of technological adoption, e.g. big data, Advanced analytics, e.g. for investment decisions, cloud… fraud detection, … Record investment in Fintech, $13.8 bn in venture capital Potential disintermediation of traditional capital market backed investments in 2015, of which > $0.5 bn in Blockchain actors Distributed ledger e.g. through Blockchain Alternative funding platform, e.g. crowdfunding New customer behaviours driven by B2C, e.g. simplicity, Emerging platforms connecting buyers and sellers speed, … AGILITY FOR GROWTH Source: CB Insights, KPMG 21

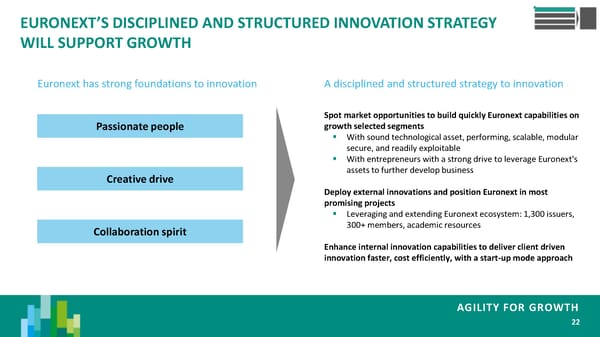

EURONEXT’S DISCIPLINED AND STRUCTURED INNOVATION STRATEGY WILL SUPPORT GROWTH Euronext has strong foundations to innovation A disciplined and structured strategy to innovation Spot market opportunities to build quickly Euronext capabilities on Passionate people growth selected segments With sound technological asset, performing, scalable, modular secure, and readily exploitable With entrepreneurs with a strong drive to leverage Euronext's Creative drive assets to further develop business Deploy external innovations and position Euronext in most promising projects Leveraging and extending Euronext ecosystem: 1,300 issuers, Collaboration spirit 300+ members, academic resources Enhance internal innovation capabilities to deliver client driven innovation faster, cost efficiently, with a start-up mode approach AGILITY FOR GROWTH 22

I CAPTURE OPPORTUNITIES ARISING V FROM THE ENVIRONMENT II ENHANCE AGILITY DELIVER VALUE TO III SHAREHOLDERS STRENGTHEN RESILIENCE OF THE CORE BUSINESS IV GROW IN SELECTED SEGMENTS AGILITY FOR GROWTH 23

ENHANCE AGILITY Stéphane Boujnah, CEO Euronext AGILITY FOR GROWTH

ENHANCE AGILITY Intensify client centricity Attract, retain and develop best talent and entrepreneurs Continue disciplined cost management Strengthen IT and infrastructure platforms Create a disciplined M&A framework AGILITY FOR GROWTH 25

ENHANCE AGILITY Upgraded IT & infrastructure platforms Jos Dijsselhof, COO AGILITY FOR GROWTH

TECHNOLOGY CONTINUES TO ACT AS AN ASSET FOR BUSINESS GROWTH 2014 2015 2016 Carved out Euronext IT from NYSE / LIFFE without impacting operations Separated, downsized and converged cash and derivatives infrastructure Optimised costs € 20 m cost reduction following closing of London IT office Relocation of back-up site Lower operating costs Enabling business growth Enhanced delivery of business and commercial initiatives Enhanced technology platform Meeting regulatory requirements Lower residual operational risk AGILITY FOR GROWTH 32

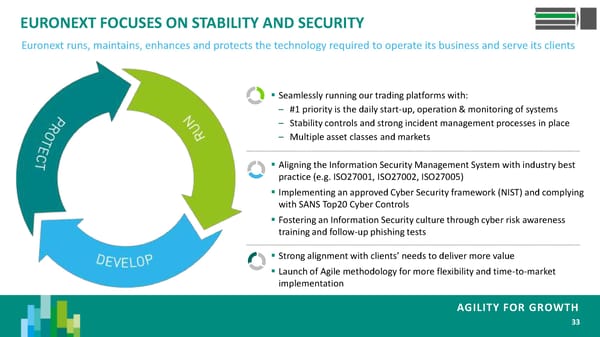

EURONEXT FOCUSES ON STABILITY AND SECURITY Euronext runs, maintains, enhances and protects the technology required to operate its business and serve its clients Seamlessly running our trading platforms with: – #1 priority is the daily start-up, operation & monitoring of systems – Stability controls and strong incident management processes in place Develop – Multiple asset classes and markets Run Aligning the Information Security Management System with industry best practice (e.g. ISO27001, ISO27002, ISO27005) Implementing an approved Cyber Security framework (NIST) and complying with SANS Top20 Cyber Controls Fostering an Information Security culture through cyber risk awareness training and follow-up phishing tests Protect Strong alignment with clients’ needs to deliver more value Launch of Agile methodology for more flexibility and time-to-market implementation AGILITY FOR GROWTH 33

EURONEXT IS ENHANCING ITS OPERATING MODEL TO DELIVER VALUE TO ITS CLIENTS A more agile organisation… Relocate teams from Belfast to Porto by 2017 Industrialise IT processes Rationalise number of sites and co-locate teams where Implement Agile methodology possible Bring on over 100 highly skilled new hires in Porto Manage IT operations and development, security and finance in conjunction with existing Paris based teams Leverage existing Portuguese presence by colocating with Interbolsa offices and functions …which provides business and financial benefits Innovative culture Cost efficient Closer to businesses and core markets More flexibility with faster delivery AGILITY FOR GROWTH 34

TO IMPROVE CUSTOMER EXPERIENCE, EURONEXT IS LAUNCHING A NEW GENERATION TECHNOLOGY PLATFORM With the cutting edge technology embedded on Optiq™, Euronext is meeting client key expectations STABILITY AND SCALABILITY AND LOW TIME SIMPLIFICATION & QUALITY OF SERVICE PREDICTABILITY TO MARKET RATIONALISATION COMPLIANCE Meet stability and Answer strong Deliver products with a Harmonise cash and Include MiFID II resiliency challenges requests for improved shorter time to market derivatives systems requirements on a Provide clients with constant latency and to better adapt to using market standard native basis improved surveillance increased throughput market demand and protocols Optimise the migration and analytics services on both cash and support strategy Automate daily strategy taking MiFID II derivatives markets Have changes impact configuration regulatory calendar Allow for high clients only if they plan processes into account scalability to use the product / services AGILITY FOR GROWTH 35

ENHANCE AGILITY M&A discipline Stéphane Boujnah, CEO Euronext AGILITY FOR GROWTH

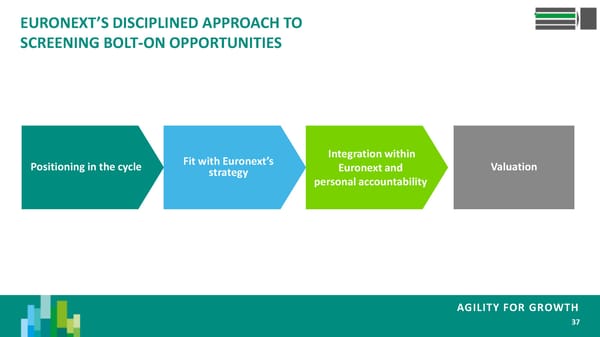

EURONEXT’S DISCIPLINED APPROACH TO SCREENING BOLT-ON OPPORTUNITIES Integration within Positioning in the cycle Fit with Euronext’s Euronext and Valuation strategy personal accountability AGILITY FOR GROWTH 37

M&A STRATEGIC PRIORITIES What does Euronext expect from acquisition targets? Value Technology Entrepreneurial Tangible results Scale proposition spirit What can Euronext offer to new teams? Powerful brand Neutrality Network Efficiency Open federal Agile model organisation AGILITY FOR GROWTH 38

A REINFORCED TEAM AND PROCESSES TO CAPTURE OPPORTUNITIES Euronext strengthened team and process Key quantitative criteria on potential targets Substantial part of the €100-€150m envelope for Strong track record in delivering Euronext’s successful IPO and stated objectives developments to be allocated to bolt-on acquisitions New dedicated team at work with the recruitment Potential to diversify Euronext revenue base and/or of: get scale Chief Innovation Officer Purchase multiple discipline Head of M&A Revenue and cost synergy potential Disciplined screening of identified opportunities to ROCE > WACC in year 3 optimise management time Solid cash conversion Investment committee put in place Deleveraging prospects Robust post acquisition integration processes Euronext will analyse any transformational transaction that might become actionable and which might deliver scale and enhanced profitability on a case by case basis AGILITY FOR GROWTH 39

I CAPTURE OPPORTUNITIES ARISING V FROM THE ENVIRONMENT II ENHANCE AGILITY DELIVER VALUE TO III SHAREHOLDERS STRENGTHEN RESILIENCE OF THE CORE BUSINESS IV GROW IN SELECTED SEGMENTS AGILITY FOR GROWTH 40

STRENGTHEN THE RESILIENCE OF THE CORE BUSINESS Lee Hodgkinson, Head of Markets and Global Sales AGILITY FOR GROWTH

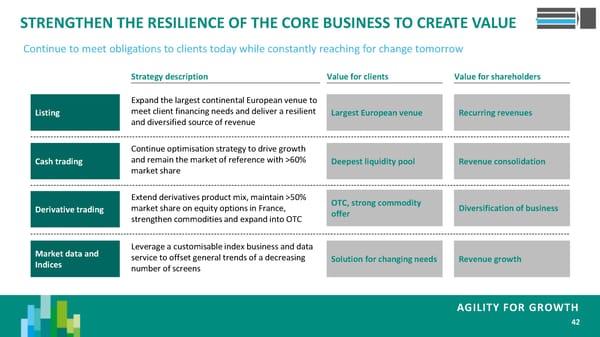

STRENGTHEN THE RESILIENCE OF THE CORE BUSINESS TO CREATE VALUE Continue to meet obligations to clients today while constantly reaching for change tomorrow Strategy description Value for clients Value for shareholders Expand the largest continental European venue to Listing meet client financing needs and deliver a resilient Largest European venue Recurring revenues and diversified source of revenue Continue optimisation strategy to drive growth Cash trading and remain the market of reference with >60% Deepest liquidity pool Revenue consolidation market share Extend derivatives product mix, maintain >50% OTC, strong commodity Derivative trading market share on equity options in France, offer Diversification of business strengthen commodities and expand into OTC Market data and Leverage a customisable index business and data Indices service to offset general trends of a decreasing Solution for changing needs Revenue growth number of screens AGILITY FOR GROWTH 42

STRENGTHEN THE RESILIENCE OF THE CORE BUSINESS Listing Anthony Attia, CEO Euronext Paris and Global Head of Listing AGILITY FOR GROWTH

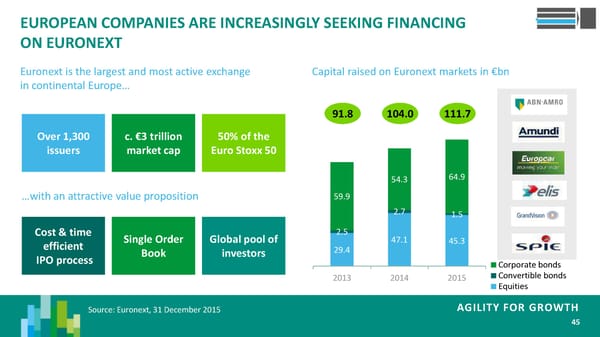

EUROPEAN COMPANIES ARE INCREASINGLY SEEKING FINANCING ON EURONEXT Euronext is the largest and most active exchange Capital raised on Euronext markets in €bn in continental Europe… 91.8 104.0 111.7 Over 1,300 c. €3 trillion 50% of the issuers market cap Euro Stoxx 50 54.3 64.9 …with an attractive value proposition 59.9 2.7 1.5 Cost & time Single Order Global pool of 2.5 47.1 efficient 45.3 IPO process Book investors 29.4 Corporate bonds 2013 2014 2015 Convertible bonds Equities Source: Euronext, 31 December 2015 AGILITY FOR GROWTH 45

EURONEXT’S LISTING REVENUE IS STABLE AND RESILIENT Annual fixed fees coming from listed products are a >70% of capital raised on equities from follow-on deals significant revenue component (>45%) in €bn in €m Others 73% 45.3 53.5 61.7 70.5 Bond fees 3.9 IPOs 76% 47.1 5.3 Follow-ons 2.9 5.3 12.3 Fixed fees 89% 29.4 2.1 5.4 9.7 6.7 16 Primary Follow on 10.3 13.4 Large M&As and spin-offs form a key revenue stream Spin-off Merger Merger Merger Merger 29 30.4 32.9 June 2015 July 2015 August 2015 September January 2016 €70m Mkt. cap €17bn + €23bn €29bn Mkt. cap 2015 €27bn + €11bn Mkt. cap €1bn Mkt. cap Mkt. cap 2013 2014 2015 AGILITY FOR GROWTH Source: Euronext 46

EURONEXT IS BOOSTING ITS FRANCHISE WITH NEW OFFERS AND INCREASED MARKET REACH Supported by increased disintermediation …and has provided new added-value services and CMU… to issuers… Visibility & communication ❶ Reinforced prudential rules Research coverage ❷ Development of diversified funding sources Data & analytics …Euronext has dynamically developed new offers… …through a strengthened sales force Private Placement Bonds: €16bn raised since launch Improved day-to-day client coverage in March 2015 Added commercial teams on the ground to attract issuers Strong SRI services: €3.6bn raised in 2015 through Developed partnerships (Asia, US, Israel) to attract investors 11 Green Bonds issuances Euronext’s aim is to increase reach to all market participants and geographies as the largest European venue AGILITY FOR GROWTH 47

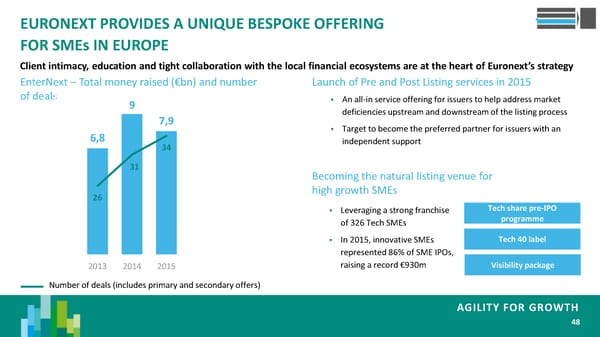

EURONEXT PROVIDES A UNIQUE BESPOKE OFFERING FOR SMEs IN EUROPE Client intimacy, education and tight collaboration with the local financial ecosystems are at the heart of Euronext’s strategy EnterNext – Total money raised (€bn) and number Launch of Pre and Post Listing services in 2015 of deals An all-in service offering for issuers to help address market 10 9 40 7,9 deficiencies upstream and downstream of the listing process 8 6,8 35 Target to become the preferred partner for issuers with an 34 independent support 6 31 30 Becoming the natural listing venue for 4 26 25 high growth SMEs Leveraging a strong franchise Tech share pre-IPO 2 20 of 326 Tech SMEs programme In 2015, innovative SMEs Tech 40 label 0 15 represented 86% of SME IPOs, 2013 2014 2015 raising a record €930m Visibility package Number of deals (includes primary and secondary offers) AGILITY FOR GROWTH 48

STRENGTHEN THE RESILIENCE OF THE CORE BUSINESS Cash trading Danielle Mensah, Head of Cash Markets AGILITY FOR GROWTH

.jpg)

EURONEXT HAS A DIVERSE STRATEGY TO DRIVE GROWTH IN CASH TRADING Quarterly cash revenues and volumes increase 20 60 es meslu Cash ADV Revenues 50 u ov15 40 even 2013-2015 CAGR aily 10 30 lyr Revenues +10.4% de 5 20 er ager 10 quart 2013-2015 CAGR v a0 0 m Volumes +12.3% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 bn € € 2013 2014 2015 2016 Focus on profitability through yield management & A top tier European Outperforming in yield nurturing market share trading venue management Product development to capture new flow & enhance €8.2bn per revenue day* 0.48 bps* Innovation to accelerate growth in ETF business AGILITY FOR GROWTH Source: Euronext analysis on book and off book regulated trades 50

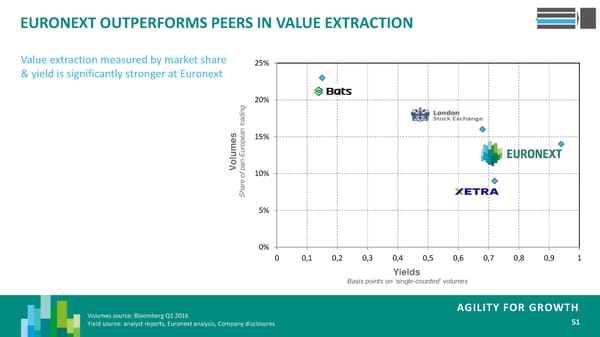

EURONEXT OUTPERFORMS PEERS IN VALUE EXTRACTION Value extraction measured by market share 25% & yield is significantly stronger at Euronext 20% ingd a tr an ep15% our olumesEn- V ap f o10% ear hS 5% 0% 0 0,1 0,2 0,3 0,4 0,5 0,6 0,7 0,8 0,9 1 Yields Basis points on ‘single-counted’ volumes AGILITY FOR GROWTH Volumes source: Bloomberg Q1 2016 51 Yield source: analyst reports, Euronext analysis, Company disclosures

EURONEXT IS THE POINT OF PRICE FORMATION WITH SUPERIOR EXECUTION QUALITY Better execution available vs. MTF competition* Strong flow diversity across multiple client types 21% Multi-Type HFT Euronext blue chips 15% Institutional Q1 2016 Euronext BATS Chi-X Equiduct Turquoise Agency Broker Average Spread 5.93 bps 11.00 bps 7.78 bps 37.11 bps 7.45 bps 8% Retail 44% Own Account Displayed market € 47,789 € 19,071 € 22,057 € 13,418 € 19,359 5% Other 4% depth at best limit 3% EBBO setter 60% 3% 18% 0% 13% In continuous trading Euronext is the source of reference Time at European 78% 27% 60% 3% 57% prices with deep liquidity Best Bid & Offer Unique liquidity points with close to 100% market share: auctions, option expiries (monthly/quarterly) Unique continental client base providing differentiated flow AGILITY FOR GROWTH *Source: TAG audit 52

EURONEXT HAS KEPT YIELDS STABLE IN A COMPETITIVE ENVIRONMENT… Average monthly yields for cash trading vs. MTFs (basis points) Segmented agency pricing 0,6 Segmented scheme positions Cash Trading Yield customers for growth, whilst 0,5 extracting value and no rebates ts0,4 in po0,3 Flagship ‘supplemental liquidity is Yield range for Chi-x, programme’ Bas0,2 BATS, Turquoise 0,1 Yield dilutive measures are precisely targeted (maker-taker scheme) 0 Q1-13 Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Q4-14 Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 AGILITY FOR GROWTH 53

… AND WILL NOT OVERPAY FOR YIELD-DILUTIVE MARKET SHARE Market share of ‘primary exchange’ on domestic blue chip index 66% 64% CAC 40 62% AEX 60% DAX 58% FTSE OMXS30 56% 54% 2015 2016 J F M A M J J A S O N D J F M Aggressive pricing for low yield, mobile HFT flow, Turquoise beating Chi-X on market share 25% 20% 15% 10% Chi-X 5% Turquoise 0% 2015 2016 BATS J F M A M J J A S O N D J F M AGILITY FOR GROWTH Source: Euronext analysis (on book regulated trades) 54

EURONEXT OUTPERFORMS PEERS IN ETFS ETFs reached a new level of investment in Europe with significant additional growth potential New dedicated & focused team 2015 volume Strong relationships with the issuers 18% CAGR in +74% on • Fastest listing process in Europe Europe over 3 Euronext • Cost efficiency to grow issuer and years* vs.+45.1% in product base Europe* Partnership with clients Organic growth through innovation ADV (€M) 1 500,0 1 000,0 500,0 0,0 AGILITY FOR GROWTH * Source: EY Global ETF Survey 2015, ETFGI, Euronext 55

STRENGTHEN THE RESILIENCE OF THE CORE BUSINESS Derivatives trading Adam Rose, Head of Financial Derivatives AGILITY FOR GROWTH

.jpg)

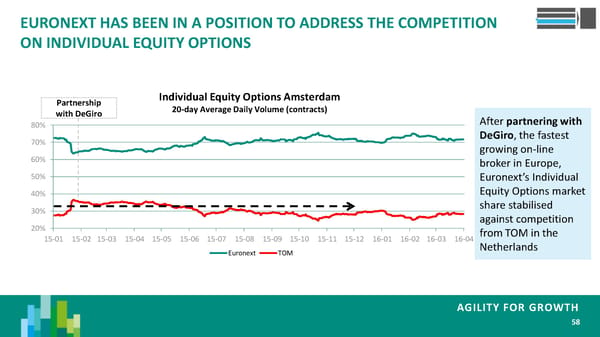

DERIVATIVES MARKET FOOTPRINT BENEFITS FROM A SOLID INDEX FRANCHISE French and Dutch options business is at the heart of Euronext’s offering ~50% volumes* comes from index derivatives 11% Index options CAC40 ® is the most traded European country index futures * 39% Index futures Exclusive to Euronext Regained Individual Equity Options (IEO) market share in an increasingly competitive market through partnering and fee adaptation 50% Individual Succeeded in re-pricing French IEO to stabilise market share ~50% Equity Products Regained market share in Netherlands vs. TOM through partnering with DeGiro, now exceeding 70% On-screen liquidity ensured with 25 market makers Top 100 most traded options are traded between 50K – 7MM p.y. AGILITY FOR GROWTH * FY 2015, by number of contracts traded 57

EURONEXT HAS BEEN IN A POSITION TO ADDRESS THE COMPETITION ON INDIVIDUAL EQUITY OPTIONS Partnership Individual Equity Options Amsterdam with DeGiro 20-day Average Daily Volume (contracts) 80% After partnering with 70% DeGiro, the fastest growing on-line 60% broker in Europe, 50% Euronext’s Individual 40% Equity Options market 30% share stabilised against competition 20% from TOM in the 15-01 15-02 15-03 15-04 15-05 15-06 15-07 15-08 15-09 15-10 15-11 15-12 16-01 16-02 16-03 16-04 Netherlands Euronext TOM AGILITY FOR GROWTH 58

COST EFFECTIVE DIVERSIFICATION WILL CAPTURE OPPORTUNITIES FROM EVOLVING CLIENT NEEDS AND REGULATORY CHANGE Portfolio diversification in asset classes and geographies New OTC capture platform AtomX to benefit from tailwind of regulatory change Asset class AtomX, Euronext’s trade capture facility, provides the benefits of diversification Coming Volatility central clearing while ensuring OTC flexibility Soon Products Coming Physically Settled Initially launched for equity products Exchange For Soon Index Futures Gradually will launch more products to support strategy on other Less-Equity Physical asset classes, with the aim to fuel the whole value chain related Single Stock Options on Dividend Futures ETFs The benefits of central clearing while retaining OTC flexibility Spotlight Coming Eliminate counterparty risk options Soon AtomX Flex Trade Reporting compliant to regulation Equity Weekly Coming AtomX non-COB More efficient portfolio margining compared to OTC related options Soon contracts Centralised management of corporate actions Single Stock Coming Equity options Futures Soon on non-Euronext underlying Euronext markets Non-Euronext markets Geographical diversification AGILITY FOR GROWTH 59

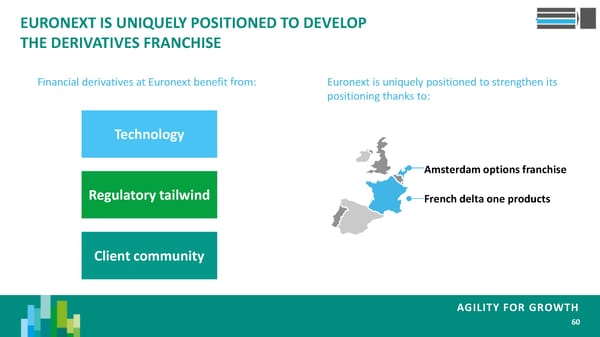

EURONEXT IS UNIQUELY POSITIONED TO DEVELOP THE DERIVATIVES FRANCHISE Financial derivatives at Euronext benefit from: Euronext is uniquely positioned to strengthen its positioning thanks to: Technology Amsterdam options franchise Regulatory tailwind French delta one products Client community AGILITY FOR GROWTH 60

STRENGTHEN THE RESILIENCE OF THE CORE BUSINESS Market Data and Indices Maurice van Tilburg, CEO Euronext Amsterdam AGILITY FOR GROWTH

EURONEXT OUTPERFORMS PEERS BY ADAPTING ITS MODEL TO SERVE EVOLVING CLIENT USAGE OF DATA Increase in revenues despite decline in the Market Data revenue has outperformed peers over number of screens purchased by clients the last 3 years 250 000 100 Market Data revenue has increased through active 200 000 management of policies and contracts 80 Addressing changes in the data usage needs of clients 150 000 Proactive presence in 140 countries via 430+ data vendors 60 Focusing on increased interest in overseas redistribution, for 100 000 example in China 50 000 40 2013* 2014 2015 # of Screens Revenues in €m AGILITY FOR GROWTH * 2013 screen numbers include LIFFE 62

DIVERSIFICATION OF DATA BUSINESS IS MEETING CHANGING CLIENT NEEDS WHILE MITIGATING THE IMPACT OF REGULATION Market evolution Leveraging opportunities and mitigating risk beyond 2019 1. REGULATION Euronext will mitigate impact through product MIFID II will lead to disaggregated data sold on a innovation reasonable commercial basis 2. DECLINE IN USER NUMBERS Shift from terminals to non-display applications. Policy changes to offset impact of future decline to Reduction in users through increased cost awareness secure revenue 3. INNOVATION IN TRADEABLE PRODUCTS Deliver new services to satisfy client demand, such as Product innovation drives demand for sophisticated sentiment analysis through a partnership with Heckyl data solutions 4. GROWTH IN FINTECH Leading to new data points and new ways of Create advanced analytics solutions delivering and consuming data AGILITY FOR GROWTH 63

REGULATED AND SCALABLE INDEX OFFERING SUPPORTS CLIENTS’ PASSIVE INVESTMENT NEEDS Strong and diversified growth in listed products… … which Euronext will capture… 8 000 +26% Tailored made indices based on our proven capability on our existing 7 000 dutsc CAC 40 AEX All indices: 6 000 x Pro 14%+ Reaction time and time to market as a differentiating factor 5 000 de Optimised customisable index processor (23h/day calculation) 4 000 nr. In 58%+ Product development with innovative partners (Carbone 4, CDP) 3 000 …all across the value chain 2 000 1 000 0 375 Indices 2013 2014 2015 Listing …in a context of favourable market trends… Calculation Attractiveness of passive investments based on indices up +8% to Licencing 20% in global AUM over 2003-2015 Derivatives and ETP trading Client appetite for new index concepts Market data Need for regulated index provider in light of Benchmark regulation AGILITY FOR GROWTH 64

I CAPTURE OPPORTUNITIES ARISING V FROM THE ENVIRONMENT II ENHANCE AGILITY DELIVER VALUE TO III SHAREHOLDERS STRENGTHEN RESILIENCE OF THE CORE BUSINESS IV GROW IN SELECTED SEGMENTS AGILITY FOR GROWTH 66

GROW IN SELECTED SEGMENTS Stéphane Boujnah, CEO Euronext AGILITY FOR GROWTH

WE ARE APPLYING A DISCIPLINED APPROACH TO INCREASE SCALE AND DIVERSIFY REVENUE STREAMS Our ambition is to accelerate our top-line growth through a realistic and coherent strategy • Adding value to issuers and investors • Leveraging our assets: technology infrastructure, network, brand, neutrality, product portfolio and industry positioning • Growing organically and accelerating growth through acquisitions • Implementing our strategy, in a disciplined and agile manner Through six growth initiatives in selected segments, we aim to deliver an uplift in top line of €70m by 2019 while continuing to strengthen the profitability of our businesses AGILITY FOR GROWTH 68

WE HAVE BEEN SYSTEMATIC AND THOROUGH IN SELECTING STRATEGIC INITIATIVES Map the Select 15 strategic Identify areas & 6 strategic universe of areas with highest select initiatives growth the possible potential initiatives • Market dynamics • Fit with growth • Feasibility of initiative • Clients’ needs ambition and principles • Capacity to execute • Euronext’s business and • Revenue potential overall strategic plan adjacencies • Euronext’s right to win • Credibility in the market place 4+ months and 100+ employees involved AGILITY FOR GROWTH 69

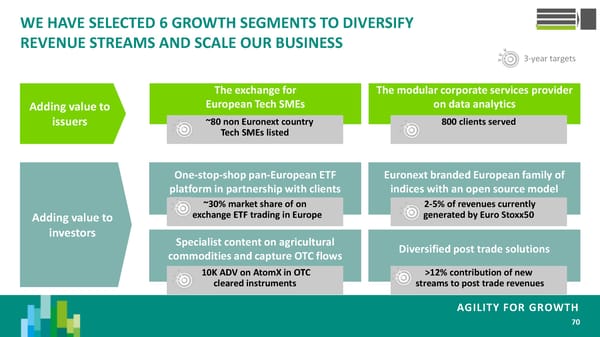

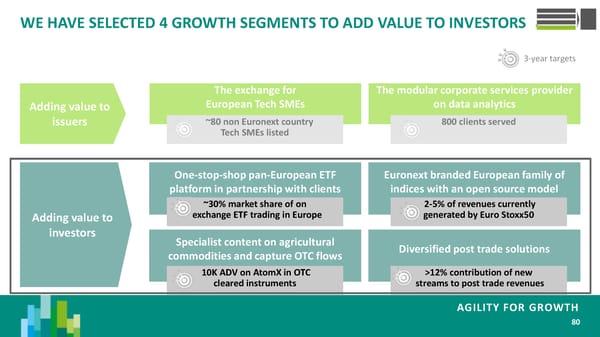

WE HAVE SELECTED 6 GROWTH SEGMENTS TO DIVERSIFY REVENUE STREAMS AND SCALE OUR BUSINESS 3-year targets The exchange for The modular corporate services provider Adding value to European Tech SMEs on data analytics issuers ~80 non Euronext country 800 clients served Tech SMEs listed One-stop-shop pan-European ETF Euronext branded European family of platform in partnership with clients indices with an open source model ~30% market share of on 2-5% of revenues currently Adding value to exchange ETF trading in Europe generated by Euro Stoxx50 investors Specialist content on agricultural Diversified post trade solutions commodities and capture OTC flows 10K ADV on AtomX in OTC >12% contribution of new cleared instruments streams to post trade revenues AGILITY FOR GROWTH 70

GROW IN SELECTED SEGMENTS Adding value to issuers: The exchange for European Tech SMEs Eric Forest, CEO EnterNext AGILITY FOR GROWTH

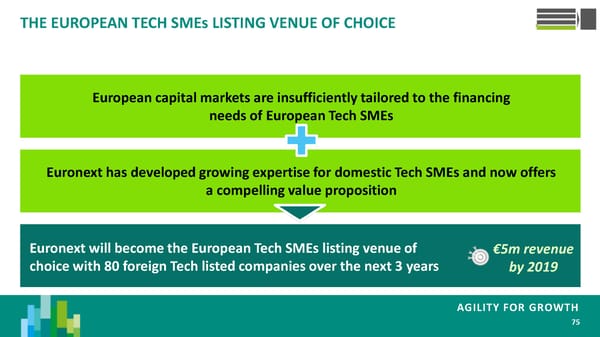

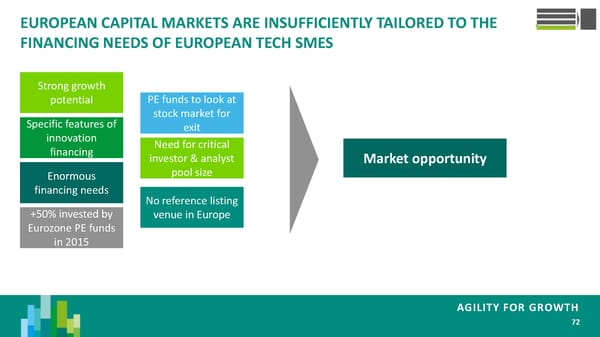

EUROPEAN CAPITAL MARKETS ARE INSUFFICIENTLY TAILORED TO THE FINANCING NEEDS OF EUROPEAN TECH SMES Strong growth potential PE funds to look at Specific features of stock market for innovation exit financing Need for critical investor & analyst Market opportunity Enormous pool size financing needs No reference listing +50% invested by venue in Europe Eurozone PE funds in 2015 AGILITY FOR GROWTH 72

EURONEXT HAS ACCUMULATED YEARS OF EXPERTISE IN RESPONDING TO THE NEEDS OF TECH SMES… 326 €38bn 70 €7bn Listed SMEs operating in Aggregated market Tech SMEs listings over Raised by Tech SMEs on the Digital, Cleantech and capitalisation the last 3 years our markets over the last Life sciences industries 3 years 630 Active institutional Dedicated value services Diversified markets with a investors offer for Tech SMEs choice of regulated and MTF platforms AGILITY FOR GROWTH Source: Euronext 73

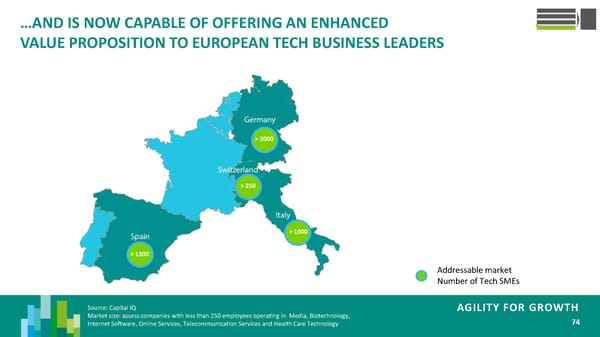

…AND IS NOW CAPABLE OF OFFERING AN ENHANCED VALUE PROPOSITION TO EUROPEAN TECH BUSINESS LEADERS > 2000 > 250 > 1000 > 1300 Addressable market Number of Tech SMEs Source: Capital IQ AGILITY FOR GROWTH Market size: assess companies with less than 250 employees operating in Media, Biotechnology, 74 Internet Software, Online Services, Telecommunication Services and Health Care Technology

THE EUROPEAN TECH SMEs LISTING VENUE OF CHOICE European capital markets are insufficiently tailored to the financing needs of European Tech SMEs Euronext has developed growing expertise for domestic Tech SMEs and now offers a compelling value proposition Euronext will become the European Tech SMEs listing venue of €5m revenue choice with 80 foreign Tech listed companies over the next 3 years by 2019 AGILITY FOR GROWTH 75

GROW IN SELECTED SEGMENTS Adding value to issuers: Data & analytics: the modular corporate services provider Lee Hodgkinson, Head of Markets and Global Sales AGILITY FOR GROWTH

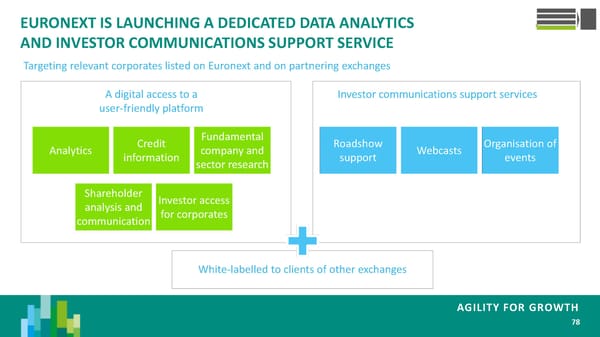

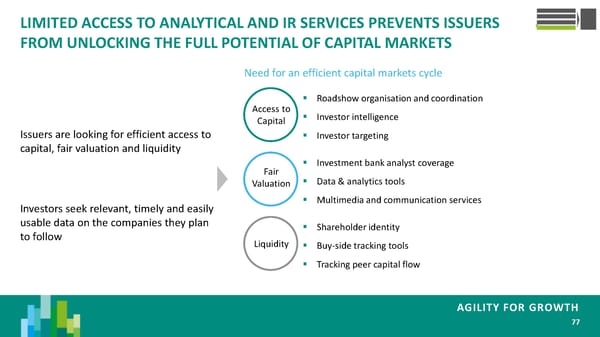

LIMITED ACCESS TO ANALYTICAL AND IR SERVICES PREVENTS ISSUERS FROM UNLOCKING THE FULL POTENTIAL OF CAPITAL MARKETS Need for an efficient capital markets cycle Roadshow organisation and coordination Access to Investor intelligence Capital Issuers are looking for efficient access to Investor targeting capital, fair valuation and liquidity Fair Investment bank analyst coverage Valuation Data & analytics tools Investors seek relevant, timely and easily Multimedia and communication services usable data on the companies they plan Shareholder identity to follow Liquidity Buy-side tracking tools Tracking peer capital flow AGILITY FOR GROWTH 77

EURONEXT IS LAUNCHING A DEDICATED DATA ANALYTICS AND INVESTOR COMMUNICATIONS SUPPORT SERVICE Targeting relevant corporates listed on Euronext and on partnering exchanges A digital access to a Investor communications support services user-friendly platform Credit Fundamental Roadshow Organisation of Analytics information company and support Webcasts events sector research Shareholder Investor access analysis and for corporates communication White-labelled to clients of other exchanges AGILITY FOR GROWTH 78

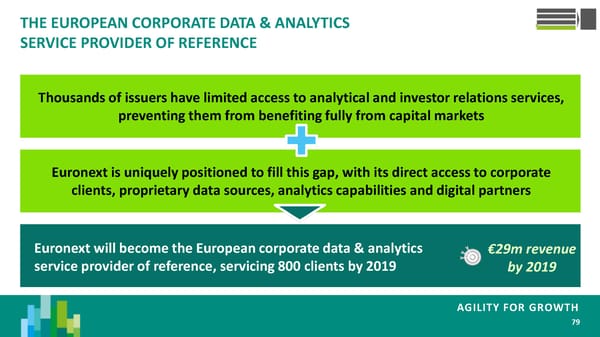

THE EUROPEAN CORPORATE DATA & ANALYTICS SERVICE PROVIDER OF REFERENCE Thousands of issuers have limited access to analytical and investor relations services, preventing them from benefiting fully from capital markets Euronext is uniquely positioned to fill this gap, with its direct access to corporate clients, proprietary data sources, analytics capabilities and digital partners Euronext will become the European corporate data & analytics €29m revenue service provider of reference, servicing 800 clients by 2019 by 2019 AGILITY FOR GROWTH 79

WE HAVE SELECTED 4 GROWTH SEGMENTS TO ADD VALUE TO INVESTORS 3-year targets The exchange for The modular corporate services provider Adding value to European Tech SMEs on data analytics issuers ~80 non Euronext country 800 clients served Tech SMEs listed One-stop-shop pan-European ETF Euronext branded European family of platform in partnership with clients indices with an open source model ~30% market share of on 2-5% of revenues currently Adding value to exchange ETF trading in Europe generated by Euro Stoxx50 investors Specialist content on agricultural Diversified post trade solutions commodities and capture OTC flows 10K ADV on AtomX in OTC >12% contribution of new cleared instruments streams to post trade revenues AGILITY FOR GROWTH 80

GROW IN SELECTED SEGMENTS Adding value to investors: ETFs: One-stop-shop pan-European ETF platform Benjamin Fussien, Head of ETFs AGILITY FOR GROWTH

.jpg)

ETFS REPRESENT A GROWING EUROPEAN MARKET OPPORTUNITY In $ tn +18% ETF/ETP AUM growth p.a. Total AUM is expected to keep growing at evolution 0.4 1,5 3.0 forecast in a pace of 18% p.a. in average for at least (global) Europe the next 3 years 2005 2010 2015 ETF/ETP In thousands Enduring global success of the UCITS listing > 6,900 ETF brand continues to spur investment evolution 0.5 4,3 6.1 listed to date optimism amongst asset managers in 1 (global) in Europe Europe 2005 2010 2015 2015 % share of ETF 2015 % ETF securities US vs. on mutual funds lending on loan Strong growth Structural upside market potential should European 4% 11% 5% 30% potential in offer opportunity to capture incremental market share Europe flow Europe US Europe US AGILITY FOR GROWTH 1. Cross listed 82 Source: ETFGI, “EY Global ETF Survey 2015” , “DB ETF Annual review & Outlook” & Euroclear

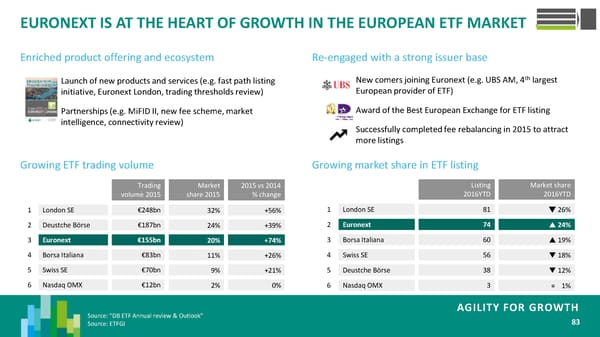

EURONEXT IS AT THE HEART OF GROWTH IN THE EUROPEAN ETF MARKET Enriched product offering and ecosystem Re-engaged with a strong issuer base Launch of new products and services (e.g. fast path listing New comers joining Euronext (e.g. UBS AM, 4th largest initiative, Euronext London, trading thresholds review) European provider of ETF) Partnerships (e.g. MiFID II, new fee scheme, market Award of the Best European Exchange for ETF listing intelligence, connectivity review) Successfully completed fee rebalancing in 2015 to attract more listings Growing ETF trading volume Growing market share in ETF listing Trading Market 2015 vs 2014 Listing Market share volume 2015 share 2015 % change 2016YTD 2016YTD 1 London SE €248bn 32% +56% 1 London SE 81 26% 2 Euronext 74 24% 2 Deustche Börse €187bn 24% +39% 3 Euronext €155bn 3 Borsa Italiana 60 19% 20% +74% 4 Borsa Italiana €83bn 11% +26% 4 Swiss SE 56 18% 5 Swiss SE €70bn 9% +21% 5 Deustche Börse 38 12% 6 Nasdaq OMX €12bn 2% 0% 6 Nasdaq OMX 3 = 1% AGILITY FOR GROWTH Source: “DB ETF Annual review & Outlook” 83 Source: ETFGI

EURONEXT WILL GAIN SCALE AND FUEL TOP LINE GROWTH THROUGH A NEW ETF OFFERING The market is fragmented and Clients are looking for a Euronext will build a dedicated opaque one-stop-shop solution MTF platform and RFQ services in partnership with clients Lack of transparency and liquidity An innovative and new end-to- es with large ETF OTC market offering end fully integrated ETF platform mluge RFQ ov an block and NAV trading A broad and flexible service to g OTC -exch nngion NAV Trading Fragmented flow and pricing capture different flow and pricing Bir mechanisms penalising the market mechanisms efficiency Leveraging existing ETF options Increased efficiency and more competitive pricing thanks to the n gty asieiid ETF Lending platform full ETF trading coverage rc liqu In AGILITY FOR GROWTH 84

ONE-STOP-SHOP PAN-EUROPEAN ETF PLATFORM IN PARTNERSHIP WITH CLIENTS Clients seek transparency, but the young and fast growing European ETF market is fragmented and opaque, with 70% of flows from OTC Euronext has a leading position in listing and trading ETFs, a strong issuer base, and a rich product portfolio Euronext will become the one-stop-shop pan-European ETF platform, €6m revenue with ~30% market share of on exchange ETF trading in Europe by 2019 AGILITY FOR GROWTH 85

GROW IN SELECTED SEGMENTS Adding value to investors: Indices: Euronext branded European family of indices Adam Rose, Head of Financial Derivatives AGILITY FOR GROWTH

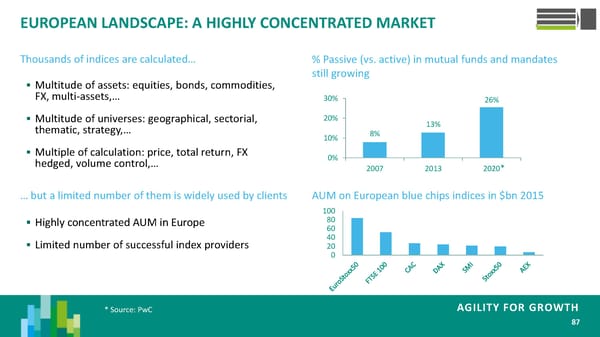

EUROPEAN LANDSCAPE: A HIGHLY CONCENTRATED MARKET Thousands of indices are calculated… % Passive (vs. active) in mutual funds and mandates still growing Multitude of assets: equities, bonds, commodities, FX, multi-assets,… 30% 26% Multitude of universes: geographical, sectorial, 20% 13% thematic, strategy,… 10% 8% Multiple of calculation: price, total return, FX 0% hedged, volume control,… 2007 2013 2020* … but a limited number of them is widely used by clients AUM on European blue chips indices in $bn 2015 100 Highly concentrated AUM in Europe 80 60 Limited number of successful index providers 40 20 0 * Source: PwC AGILITY FOR GROWTH 87

THE INDEX INDUSTRY IS STRUGGLING TO MEET EVOLVING AND GROWING CLIENT NEEDS The index industry is no longer in line… …with clients’ needs and requirements Increasing index licencing fees and associated market Growing pressure on costs and search for cheaper data fees alternatives Access to key data elements only available on a Increasing need for transparency (impacting chargeable basis benchmark regulation to be implemented in 2018) Concentration trend in the index industry - limited Increasing competitiveness, in particular between buy credible suppliers side asset managers and structured product desks, spurring client appetite for multiple offering/alternatives Opportunity to launch an alternative index model to complete Euronext’s current national focused offering AGILITY FOR GROWTH 88

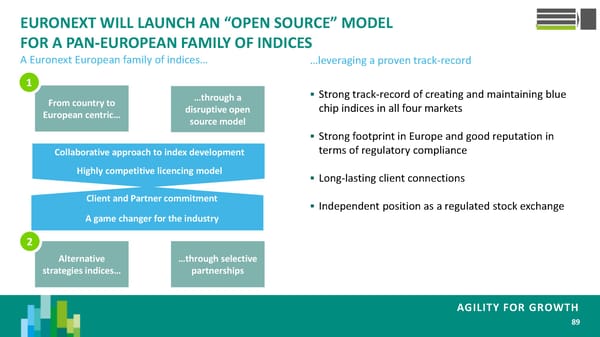

EURONEXT WILL LAUNCH AN “OPEN SOURCE” MODEL FOR A PAN-EUROPEAN FAMILY OF INDICES A Euronext European family of indices… …leveraging a proven track-record 1 Strong track-record of creating and maintaining blue From country to …through a chip indices in all four markets European centric… disruptive open source model Strong footprint in Europe and good reputation in Collaborative approach to index development terms of regulatory compliance Highly competitive licencing model Long-lasting client connections Client and Partner commitment Independent position as a regulated stock exchange A game changer for the industry 2 Alternative …through selective strategies indices… partnerships AGILITY FOR GROWTH 89

EURONEXT BRANDED EUROPEAN FAMILY OF INDICES WITH AN OPEN SOURCE MODEL Client demand for indices continues to grow but the highly concentrated industry is unable to meet their needs in terms of transparency, cost, and diversity Euronext has a proven track record in creating and maintaining blue chip indices in four markets, supported by long-lasting client relationships Euronext will launch a European family of indices €12m revenue with an open source model by 2019 across the value chain AGILITY FOR GROWTH 90

GROW IN SELECTED SEGMENTS Adding value to investors: Commodities: Specialist content on agricultural commodities Olivier Raevel – Head of commodity derivatives AGILITY FOR GROWTH

EURONEXT’S COMMODITIES FRANCHISE IS RESILIENT AND GROWING 70 000 in lots per ADV 12-Month rolling average show CAGR of +11% trading day Jan-Apr 2016 average stands at 65,212 lots 60 000 50 000 40 000 30 000 20 000 10 000 0 AGILITY FOR GROWTH 92

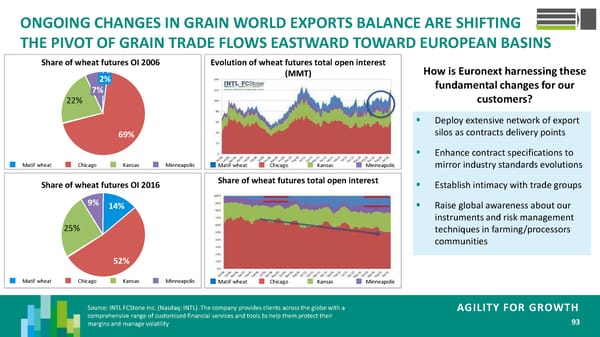

ONGOING CHANGES IN GRAIN WORLD EXPORTS BALANCE ARE SHIFTING THE PIVOT OF GRAIN TRADE FLOWS EASTWARD TOWARD EUROPEAN BASINS Share of wheat futures OI 2006 Evolution of wheat futures total open interest How is Euronext harnessing these 2% (MMT) 7% fundamental changes for our 22% customers? Deploy extensive network of export 69% silos as contracts delivery points Enhance contract specifications to Matif wheat Chicago Kansas Minneapolis Matif wheat Chicago Kansas Minneapolis mirror industry standards evolutions Share of wheat futures OI 2016 Share of wheat futures total open interest Establish intimacy with trade groups 9% 14% Raise global awareness about our instruments and risk management 25% techniques in farming/processors communities 52% Matif wheat Chicago Kansas Minneapolis Matif wheat Chicago Kansas Minneapolis Source: INTL FCStone Inc. (Nasdaq: INTL). The company provides clients across the globe with a AGILITY FOR GROWTH comprehensive range of customised financial services and tools to help them protect their 93 margins and manage volatility

EURONEXT IS SERVICING INDUSTRIAL NEEDS FOR ADEQUATE PRICE-DISCOVERY MECHANISMS ALONG 4 CORE DIRECTIONS 2014 2015 2016 Beyond… Moving along EU CAP Deregulation Calendar: Active initiative in domestic EU Sugar and beyond… Deregulation achieved in EU CAP Further Dairy SMP / Butter / Whey Adjacencies of Co-design/ Products families: manage products Quick Win Partnering: Euronext core franchise: Extension of Nitrogen-based with Frontier J.S.E.Cross-Licensing Milling Wheat existing Products: Fertilizer Market Partners in: & Global Index Rapeseed and Corn Rapeseed Complex Latin America Weightings rebalancing (Oil+Meal) and beyond… China Or Geographic Africa Eurozone industries lacking Extensions: proper price-discovery mechanisms: Black Sea Grain Biomass and beyond… Leveraging Euronext Countries Strategic Advantages: Beyond… AGILITY FOR GROWTH 94

AMBITIOUS TARGETS TO BECOME THE LEADING SPECIALIST CONTENT PROVIDER AND EXPAND ATOMX INTO COMMODITIEST PROVIDER COMMODITIES Clients are looking for additional services and a wider array of instruments in commodities, as well as greater transparency and deeper analysis Euronext has been expanding its commodities franchise systematically into adjacent areas to respond to our clients’ needs for adequate price-discovery mechanisms Euronext will become the leading specialist content provider €10m revenue and expand Atomx into commodities, with 10K ADV1 by 2019 AGILITY FOR GROWTH 96

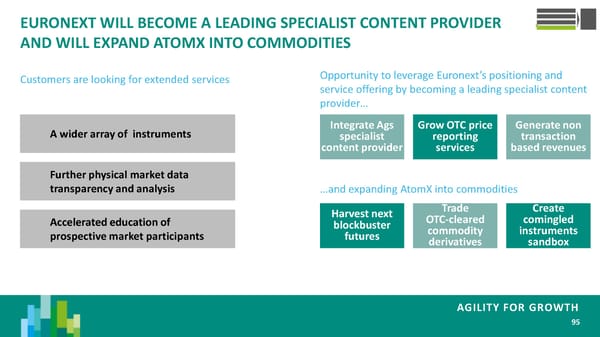

EURONEXT WILL BECOME A LEADING SPECIALIST CONTENT PROVIDER AND WILL EXPAND ATOMX INTO COMMODITIES Customers are looking for extended services Opportunity to leverage Euronext’s positioning and service offering by becoming a leading specialist content provider… A wider array of instruments Integrate Ags Grow OTC price Generate non specialist reporting transaction content provider services based revenues Further physical market data transparency and analysis …and expanding AtomX into commodities Harvest next Trade Create Accelerated education of blockbuster OTC-cleared comingled prospective market participants futures commodity instruments derivatives sandbox AGILITY FOR GROWTH 95

GROW IN SELECTED SEGMENTS Adding value to investors: Post trade solutions Andrew Simpson – Head of Post Trade AGILITY FOR GROWTH

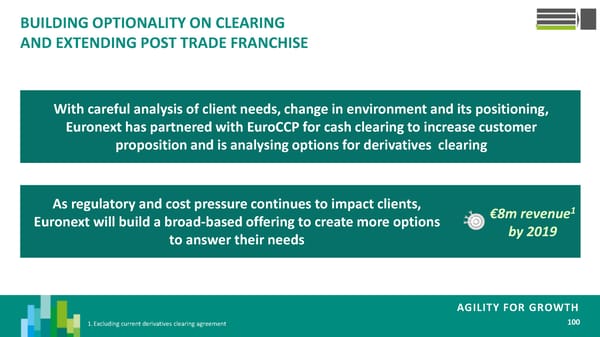

BUILDING OPTIONALITY ON CLEARING AND EXTENDING POST TRADE FRANCHISE With careful analysis of client needs, change in environment and its positioning, Euronext has partnered with EuroCCP for cash clearing to increase customer proposition and is analysing options for derivatives clearing As regulatory and cost pressure continues to impact clients, €8m revenue1 Euronext will build a broad-based offering to create more options by 2019 to answer their needs AGILITY FOR GROWTH 1.Excluding current derivatives clearing agreement 100

I CAPTURE OPPORTUNITIES ARISING V FROM THE ENVIRONMENT II ENHANCE AGILITY DELIVER VALUE TO III SHAREHOLDERS STRENGTHEN RESILIENCE OF THE CORE BUSINESS IV GROW IN SELECTED SEGMENTS AGILITY FOR GROWTH 102

DELIVER VALUE TO SHAREHOLDERS Giorgio Modica, CFO AGILITY FOR GROWTH

MAIN DRIVERS OF EURONEXT’S TRANSACTIONAL BUSINESS Volume and yield are the main top line drivers of Euronext’s volume related business Volume impact Yield performance 7,0 5,4 5,5 6,5 8,3 8,3 0,523 0,505 0,492 0,501 0,465 0,478 Historic 68% 67% 66% 64% 64% 61% trend 2011 2012 2013 2014 2015 Q1-16 2011 2012 2013 2014 2015 Q1-16 Cash trading ADV (€bn) Market Share (%) Yield (bps) Outlook Low single digit growth per year over the period and Ongoing challenge around yield maintenance stable ~60% market share 843 653 576 565 529 563 0,424 0,369 0,332 0,322 0,328 0,314 Historic Derivatives trend 2011 2012 2013 2014 2015 Q1-16 2011 2012 2013 2014 2015 Q1-16 trading ADV (€bn) Yield (in bps per lot) Outlook Mid to high single digit growth per year over the period Pressure on revenue capture will continue but most of and slight market share recovery the fee adjustments have already been performed Base Best Base Best Impact on revenues +€35m Management +€65m -€28m Management -€14m 1 upon scenarios +€50m -€21m AGILITY FOR GROWTH 1.Excluding clearing operations 104

BUILDING BLOCKS OF 2019 SALES TARGET (EXCL. GROWTH INITIATIVES) Core business1 expected to grow 2% per year €519m +€50m +€10m €505m €467m -€21m -€52m +€29m +€39m 2015 reported Clearing 2015 reported excl. Volume impact Yield pressure Non-volume 2019 target1 adjustment clearing business Volume-related business AGILITY FOR GROWTH 1.Excluding clearing operations 105

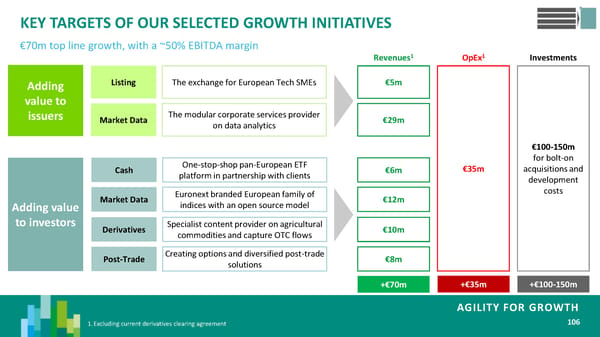

KEY TARGETS OF OUR SELECTED GROWTH INITIATIVES €70m top line growth, with a ~50% EBITDA margin 1 1 Revenues OpEx Investments Adding Listing The exchange for European Tech SMEs €5m value to issuers Market Data The modular corporate services provider €29m on data analytics €100-150m One-stop-shop pan-European ETF for bolt-on Cash platform in partnership with clients €6m €35m acquisitions and development Euronext branded European family of costs Adding value Market Data indices with an open source model €12m to investors Derivatives Specialist content provider on agricultural €10m commodities and capture OTC flows Post-Trade Creating options and diversified post-trade €8m solutions +€70m +€35m +€100-150m AGILITY FOR GROWTH 1.Excluding current derivatives clearing agreement 106

TARGET REVENUE EVOLUTION 1 €575m target , implying a ~5% CAGR 2015-19 with further potential growth upside related to clearing activities +1% CAGR 2015-19E +€71m €646m +€70m €575m €519m +€39m €467m -€52m 2015 reported Clearing 2015 reported Core business Selected 2019 target Clearing add- 2019 target adjustment excl. clearing growth back2 incl. clearing 1. Excluding clearing operations AGILITY FOR GROWTH 2. Clearing revenues for 2019 estimated on the basis of the current derivatives clearing agreement, 107 taking into account volume assumptions for 2019

CONTINUOUS COST MANAGEMENT DISCIPLINE €15m of net additional cost reductions, adding-up to the €85m already completed since the IPO +€31m €250m €235m +€35m €219m €207m -€28m -€8m +€7m -€22m -€15m net additional savings 2015 reported Clearing 2015 reported End of first Additional Inflation Selected 2019 target Clearing add- 2019 target 2 3 adjustment excl. clearing strategic plan cost adjustment growth back incl. clearing (Q1 16)1 reductions 1. Including inflation in Q1 2016 cost savings AGILITY FOR GROWTH 2. Assuming 1% inflation per year 3. Clearing costs for 2019 estimated on the basis of the current derivatives clearing agreement, taking into 108 account volume assumptions for 2019

OVERVIEW OF 2019 FINANCIAL TARGETS1 Core business Selected Total growth initiatives Revenues1 +2% CAGR 2015-19E +3% CAGR 2015-19E +5% CAGR 2015-19E +€39m +€70m €575m Costs1 -3% CAGR 2015-19E +4% CAGR 2015-19E +1% CAGR 2015-19E -€23m2,3 +€35m €219m Volume impact Adding value to issuers 61-63% Drivers / targets EBITDA margin Yield pressure Adding value to investors 1.Revenues and operating expenses excluding clearing derivatives agreement AGILITY FOR GROWTH 2.Including inflation adjustment, assuming 1% per year over the period 3.Including Q1 2016 cost reductions 109

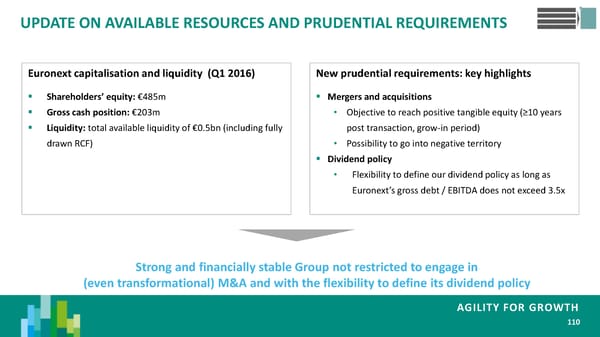

UPDATE ON AVAILABLE RESOURCES AND PRUDENTIAL REQUIREMENTS Euronext capitalisation and liquidity (Q1 2016) New prudential requirements: key highlights Shareholders’ equity: €485m Mergers and acquisitions Gross cash position: €203m • Objective to reach positive tangible equity (≥10 years Liquidity: total available liquidity of €0.5bn (including fully post transaction, grow-in period) drawn RCF) • Possibility to go into negative territory Dividend policy • Flexibility to define our dividend policy as long as Euronext’s gross debt / EBITDA does not exceed 3.5x Strong and financially stable Group not restricted to engage in (even transformational) M&A and with the flexibility to define its dividend policy AGILITY FOR GROWTH 110

CAPITAL ALLOCATION POLICY Key principles of capital allocation Targets Preserve Euronext financial and strategic agility and create Investment grade profile value for investors Investments / M&A thresholds: Disciplined and focused approach to capital allocation • ROCE > WACC in year 3 Flexibility to take advantage from selected strategic opportunities Capital return to shareholders: • Dividend payout: 50% of reported net earnings Proactive and periodic re-assessment of Euronext financial • Possibility to consider extraordinary capital return to structure shareholders should material M&A not materialise Disciplined approach to capital management AGILITY FOR GROWTH 111

WRAP-UP Stéphane Boujnah, CEO Euronext AGILITY FOR GROWTH

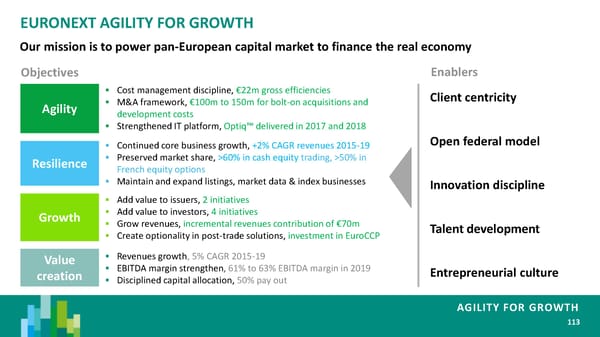

EURONEXT AGILITY FOR GROWTH Our mission is to power pan-European capital market to finance the real economy Objectives Enablers Cost management discipline, €22m gross efficiencies Client centricity Agility M&A framework, €100m to 150m for bolt-on acquisitions and development costs Strengthened IT platform, Optiq™ delivered in 2017 and 2018 Continued core business growth, +2% CAGR revenues 2015-19 Open federal model Resilience Preserved market share, >60% in cash equity trading, >50% in French equity options Maintain and expand listings, market data & index businesses Innovation discipline Add value to issuers, 2 initiatives Growth Add value to investors, 4 initiatives Grow revenues, incremental revenues contribution of €70m Talent development Create optionality in post-trade solutions, investment in EuroCCP Value Revenues growth, 5% CAGR 2015-19 creation EBITDA margin strengthen, 61% to 63% EBITDA margin in 2019 Entrepreneurial culture Disciplined capital allocation, 50% pay out AGILITY FOR GROWTH 113